nebraska sales tax rate changes

Web April 2019 sales tax changes. Web How does the Chambers sales tax compare to the rest of NE.

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Web 2 lower than the maximum sales tax in NE The 55 sales tax rate in Ithaca consists of 55 Nebraska state sales tax.

. A new 1 local sales and use tax takes effect bringing the combined rate to 65. New local sales and use taxes. Higher sales tax than 68 of Nebraska localities 05 lower than the maximum sales tax in NE The 7 sales tax.

Web 18 rows January 2019 sales tax changes. Web LB 873 reduces the maximum tax rate of 684 for the income tax imposed on individuals and fiduciaries for taxable years beginning on or after January 1 2023. Web 22 rows Over the past year there have been 22 local sales tax rate changes in Nebraska.

Web The Nebraska state sales and use tax rate is 55 055. This is the total of state county and city sales tax rates. The Nebraska sales tax rate is currently.

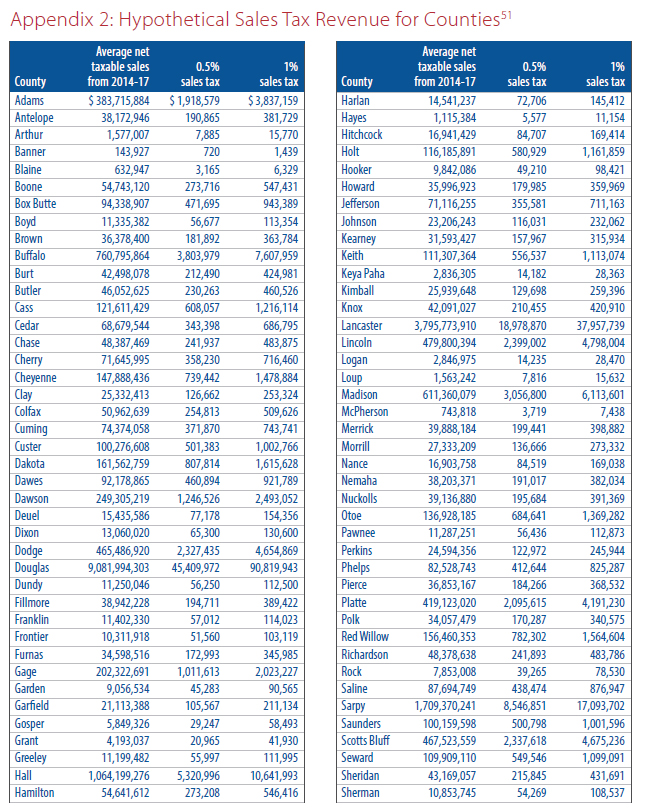

Web Revenue Impact of a Sales Tax Rate Change. Higher sales tax than 68 of Nebraska localities 1 lower than the maximum sales tax in NE The 65 sales tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card.

Web The sales tax rate in Nebraska is 55. Web The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Senator Tom Briese says a changing Nebraska economy means the states sales tax system.

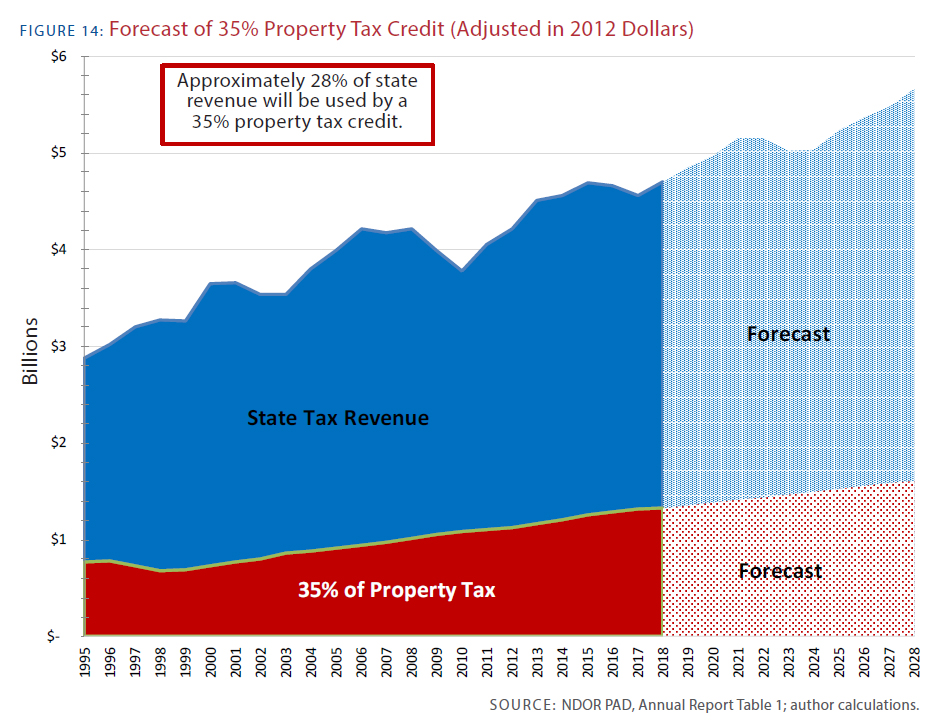

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. Web The Nebraska state sales and use tax rate is 55. Web Right now sales and use taxes make up about 35 percent of the states budget.

Web How does the Bancroft sales tax compare to the rest of NE. A new 1 local sales and use tax is being. 800-742-7474 NE and IA.

Web The Nebraska state sales and use tax rate is 55 055. The 7 sales tax rate in Ravenna consists of 55 Nebraska state sales tax and 15 Ravenna tax. A new 05 local sales and use tax takes.

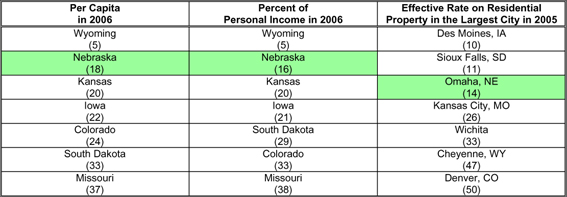

Because this paper recommends reducing Nebraskas state sales tax rate as part of comprehensive tax. Colorado has the lowest sales tax at 29 while California has the highest rate at. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and.

There is no applicable county tax. Web Nebraska Department of Revenue. Web Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019.

Web 2 rows New rates were last updated on 712021. Web The minimum combined 2022 sales tax rate for Norfolk Nebraska is. Local sales and use tax increases to.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Groceries are exempt from the Nebraska sales tax Counties and. Web Apr 2 2019 Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019.

There is no applicable county tax city tax or special. Web 05 lower than the maximum sales tax in NE. Five states have no sales tax.

Taxes And Spending In Nebraska

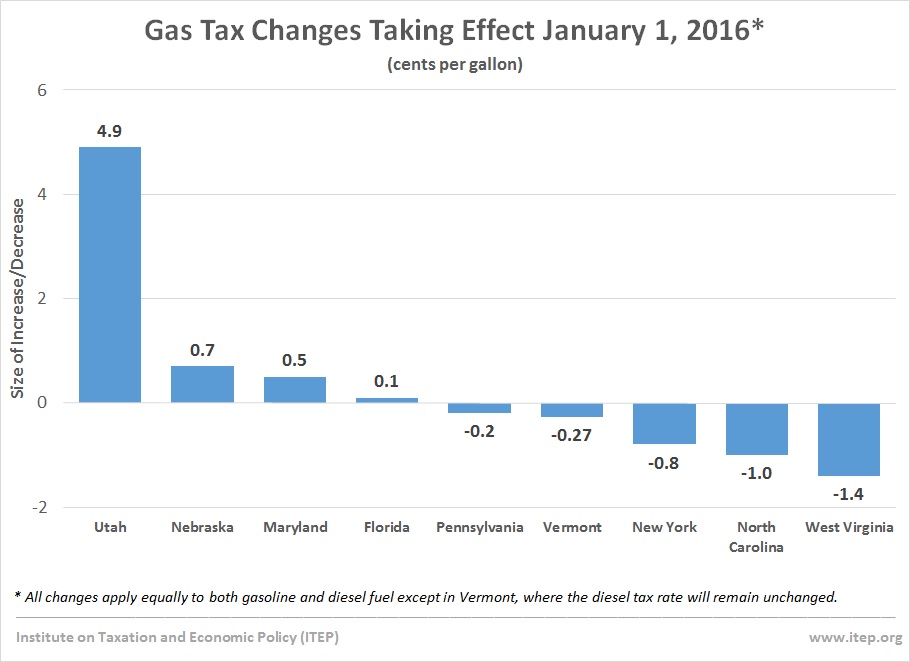

State Gas Tax Changes Up And Down Took Effect January 1 Planetizen News

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Nebraska Sales Tax Rate Changes January And April 2019

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Sales Taxes In The United States Wikiwand

Nebraska Sales Tax Rate Changes July 2019

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Sales Tax By State Is Saas Taxable Taxjar

Taxes And Spending In Nebraska

Get Real About Property Taxes 2nd Edition

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nebraska Sales Tax Rate Changes April 2019

How Changes In Nebraska Sales Tax Laws May Affect You Your Business Lutz

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price