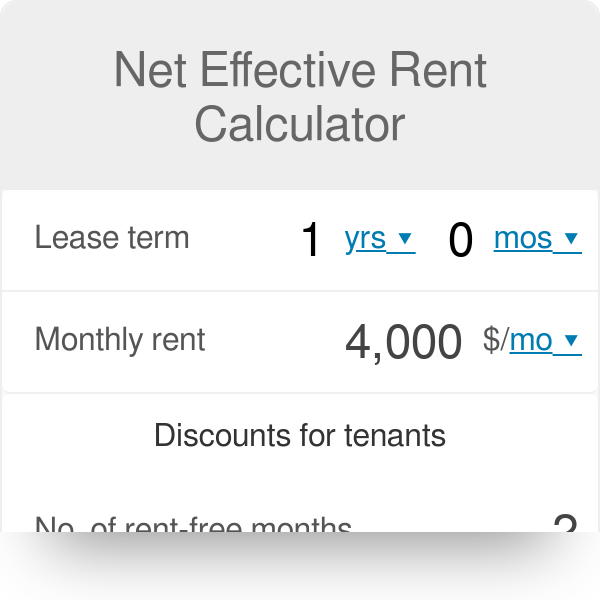

open end lease calculator

You can give the car back unlike the open end lease which forces you to buy the car at lease term. In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency.

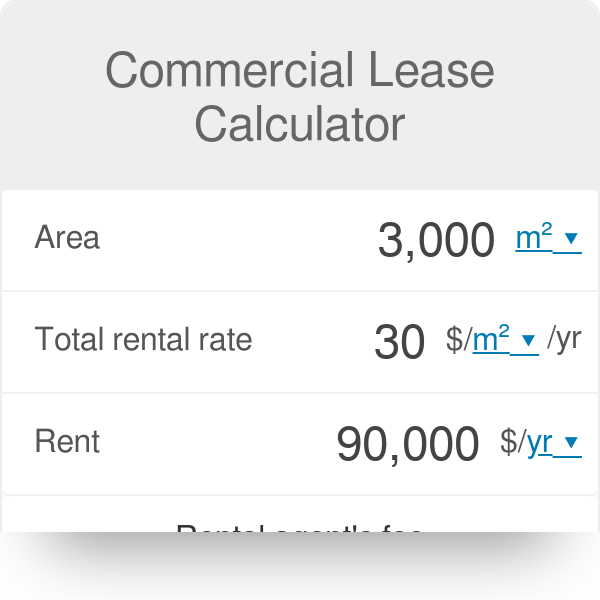

Costs And Benefits Of Restaurant Equipment Leasing

You also have the ability to customize your new or used vehicle by adding the necessary upfit equipment.

. There are four different actions the lessee can take on the vehicle at the end of a term. In a closed-end lease the leasing company takes on the risk of any additional depreciation. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

The final payment of an open-end lease is based on the difference between the residual projected value of the property leased and its realized actual value. However if the net sale price plus unpaid charges exceed the residual value the customer is entitled to the excess. From the down payment to the your monthly obligation to the residual balloon.

Open-end luxury leasing with Manhattan Funding gives you the options and clarity you need. With The Right TRAC GM Financials open-ended lease product you have the freedom to determine your monthly payment by setting the term and residual that works best for you and your business. Your lease your terms.

In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible. Youre responsible for the value of the contract during its duration and for the residual value at completion. An open-end lease is a contractual agreement between a lessor owner and the lessee renter that holds the lessee responsible for the value of the property.

The most common type of car lease also known as a closed-end lease. The employer takes all the financial risk. A lease contract with residual value for a term between 12 and 66 months and without residual up to 72 months.

The amount that the dealership will credit you for the vehicle you provide as partial or full payment for another vehicle. With an open-end lease the final lease payment is established upfront. Dont forget you can lease used vehicles as well as new.

When you lease a car youll usually be offered a closed-end lease. However youre responsible for the cars residual value at the end of the lease. Amount credited is frequently about 5 percent below the wholesale value of the vehicle.

This works well for employers since the cost of the vehicles can be written-off or. With our leases you dont have to wait until the lease term ends to switch vehicles. Do not be deceived about an option when leasing a car.

Youre responsible for all the. Open-end leases are typically less expensive than closed-end leases but they also come with more risk. Our forensic accounting and underwriting capabilities combined with 5 credit tiers on our lease calculator provide quick and accurate lease quotes on cars over 100k from 12 to 72 months.

3224 Kempt Road Halifax NS. Open-end leases also exist and are most often used in the case of commercial business lending. In a Nutshell.

Please select the price by moving the slider. This means that you could potentially owe more money should your car depreciate. Buy it return it trade it or extend the contract if.

Whether it be a closed end lease with kilometre restrictions or an open end lease with unlimited kilometres our leasing experts can determine what is right for you. However with an open-end lease the terms are generally more flexible. With Manhattan Funding you can customize the lease that suits you.

Please select the number of. Please select the required levels and you will get the results at the end of this form. Tenor number of months.

Calculate Your Car Lease-End Options. A lease providing for increases in rental payment at specified dates. A lease contract for a term between 12 and 36 months.

Pre-tax monthly payment 54760. For a lessee renter the end of a term on a car lease means it is time to make a decision regarding the vehicle and the residual value written on the contract. An open-end lease gives businesses more control of leasing terms and mileage while holding the business liable for the vehicles depreciation.

For example if your lease early termination payoff is 16000 and the amount credited for the vehicle is 14000 your early termination charge will be 16000 minus 14000 or 2000. An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease agreement.

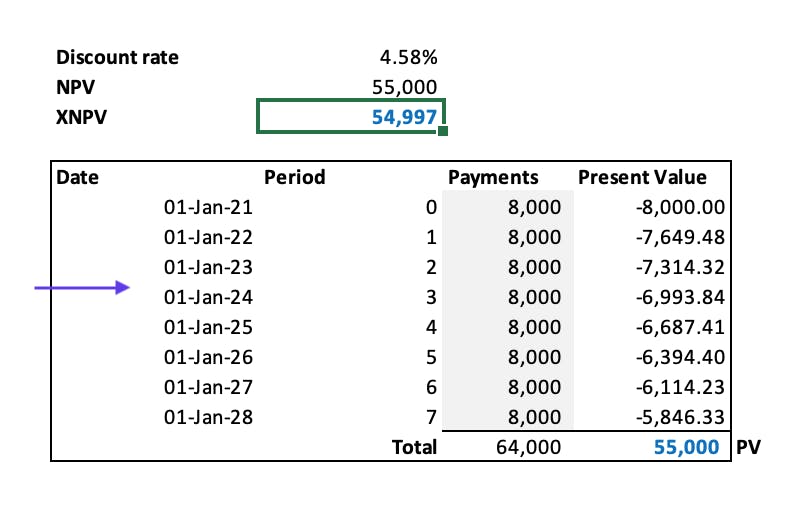

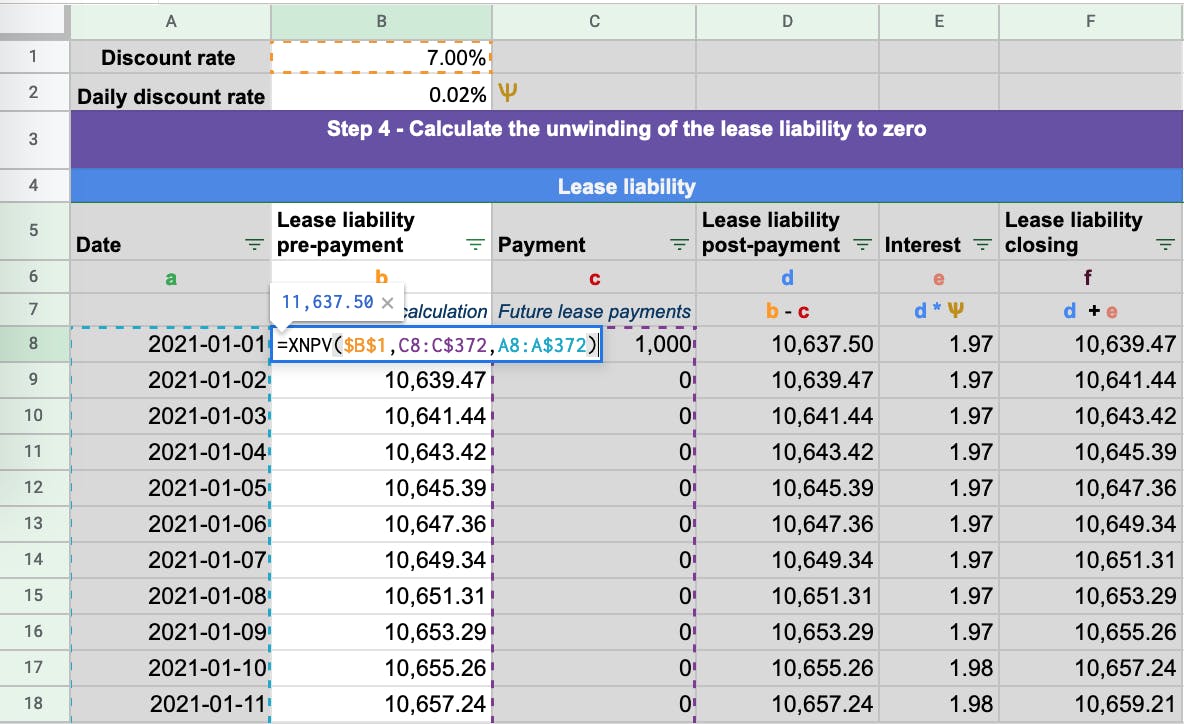

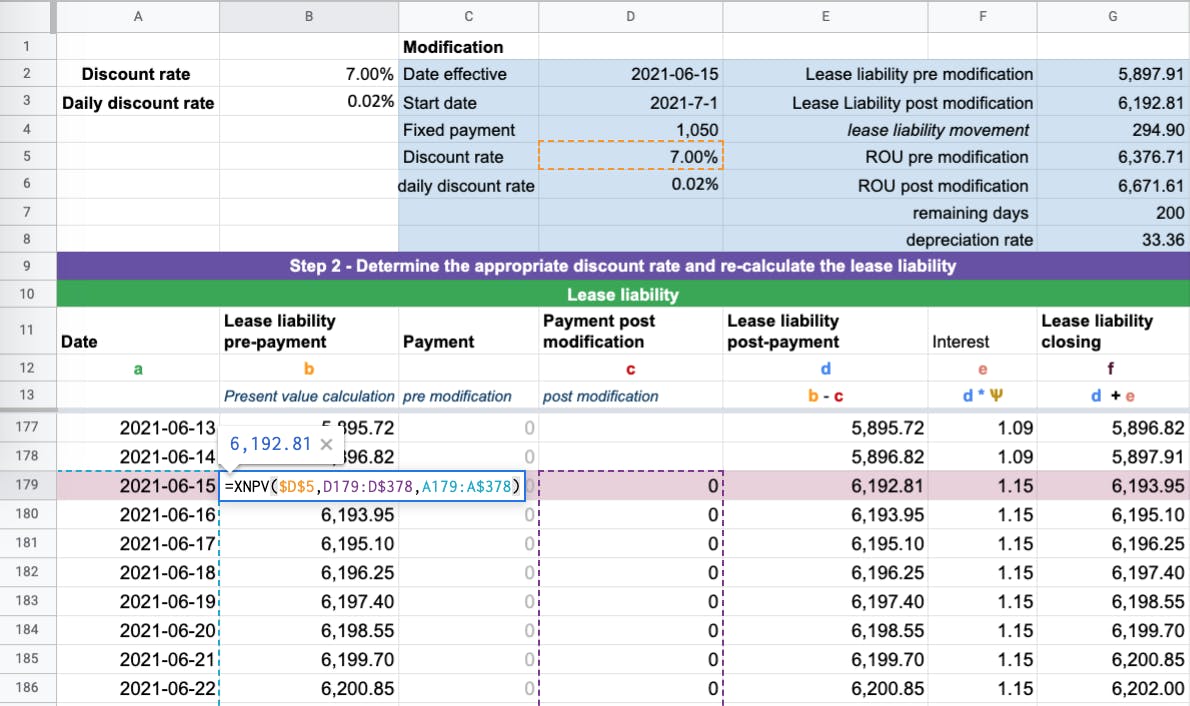

How To Calculate The Discount Rate Implicit In The Lease

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Calculate The Residual Value Of Your Lease Copilot

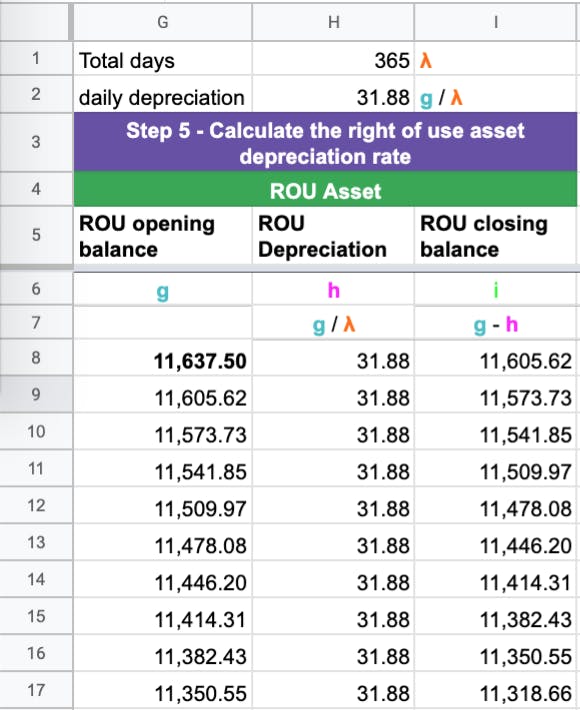

How To Calculate The Lease Liability And Right Of Use Rou Asset For An Operating Lease Under Asc 842

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

9 Questions To Ask Before Leasing A Car Bankrate

Should You Lease And Then Buy A Car Bankrate

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Profit From An Off Lease Car Kelley Blue Book

What Is Lease Accounting Why Is It Important

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Open Vs Closed End Leases What To Know Credit Karma

What Is Residual Value When You Lease A Car Credit Karma

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)